How to Create a Payroll Schedule? #

PayPeople Makes payroll processing for your company simple and error-free. PayPeople payroll automates all wage computations, follows local regulations, and ensures that all regulatory requirements are met. You can schedule a payroll according to your own required time.

What you can do here:

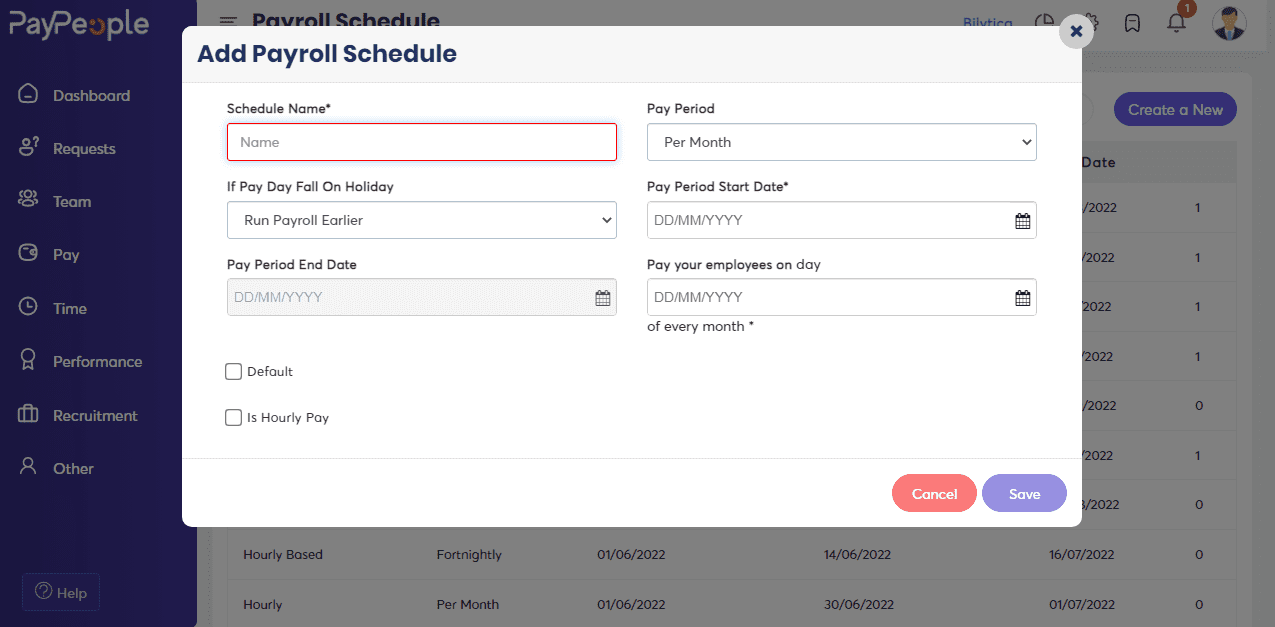

- Give the payroll schedule a name.

- Set the pay period to monthly or fortnightly.

- Set the dates: Start date and date of salary payment.

- Check box: Set the salary template default or hourly pay.

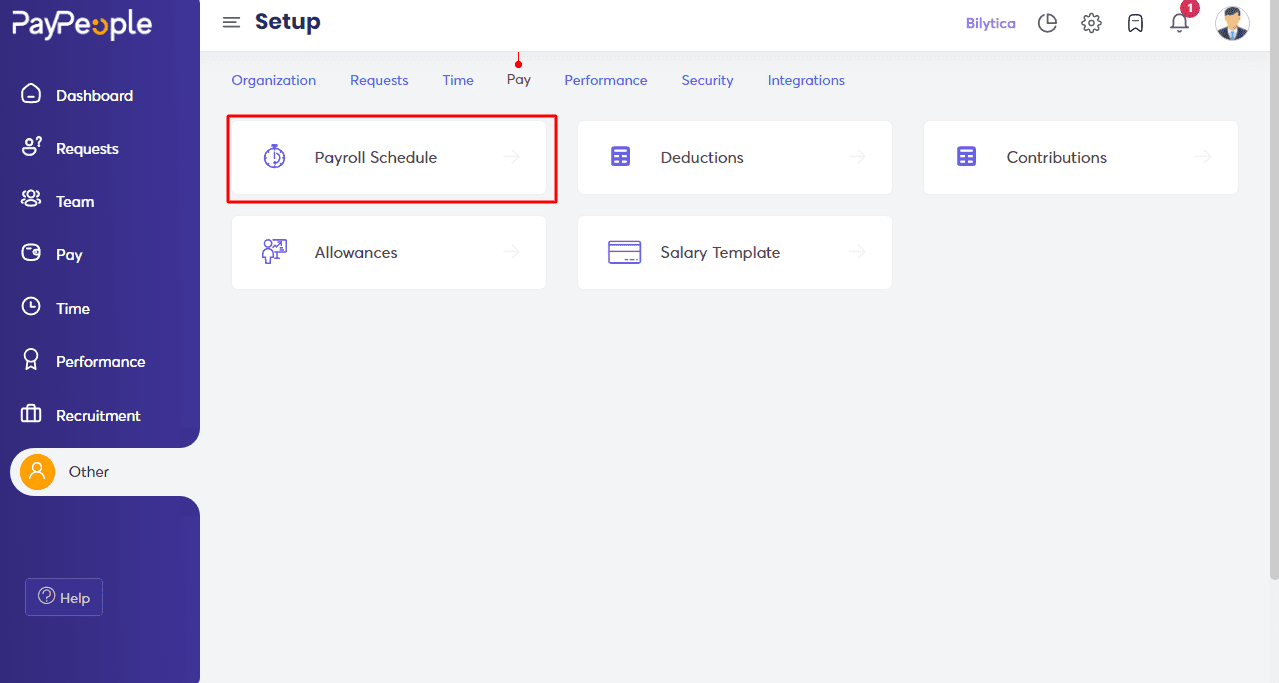

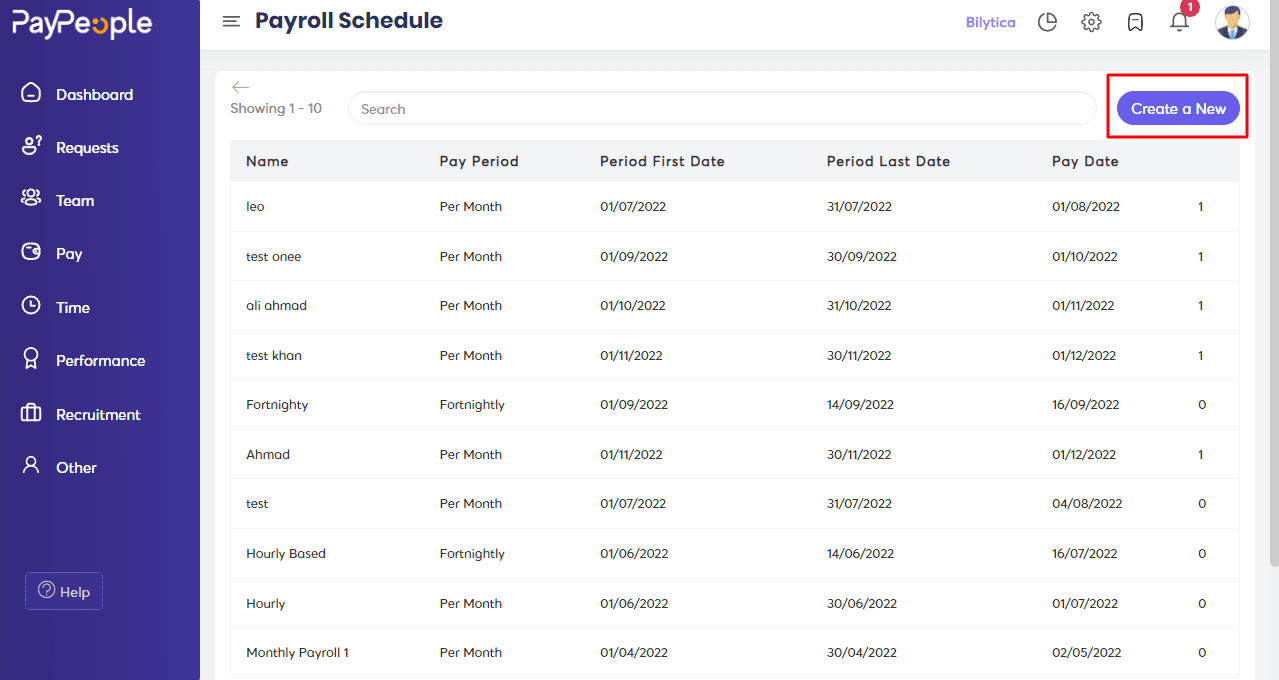

To create a payroll schedule

- Go to Setup -> Pay-> Payroll Schedule

- Select “Create a new” in the top right corner.

- Fill in the required fields that appear on the screen.

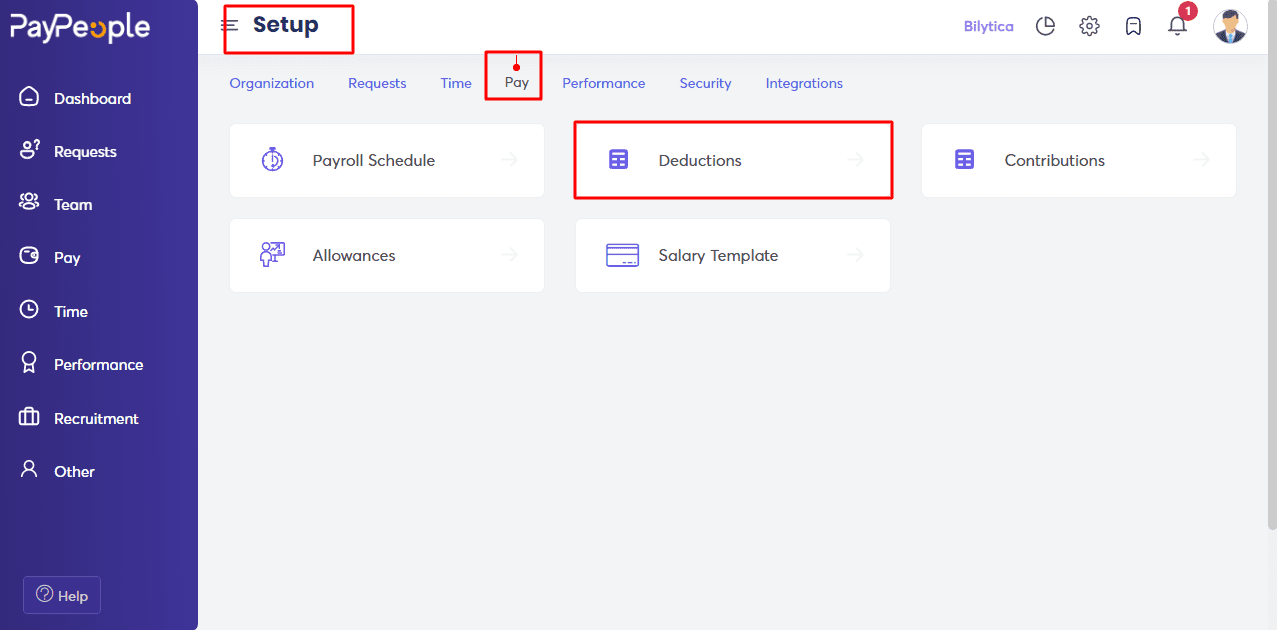

How to add Deductions? #

PayPeople also has a deduction attribute that allows you to apply various types of deductions to an employee’s salary. You can edit an existing deduction as well as create a new deduction.

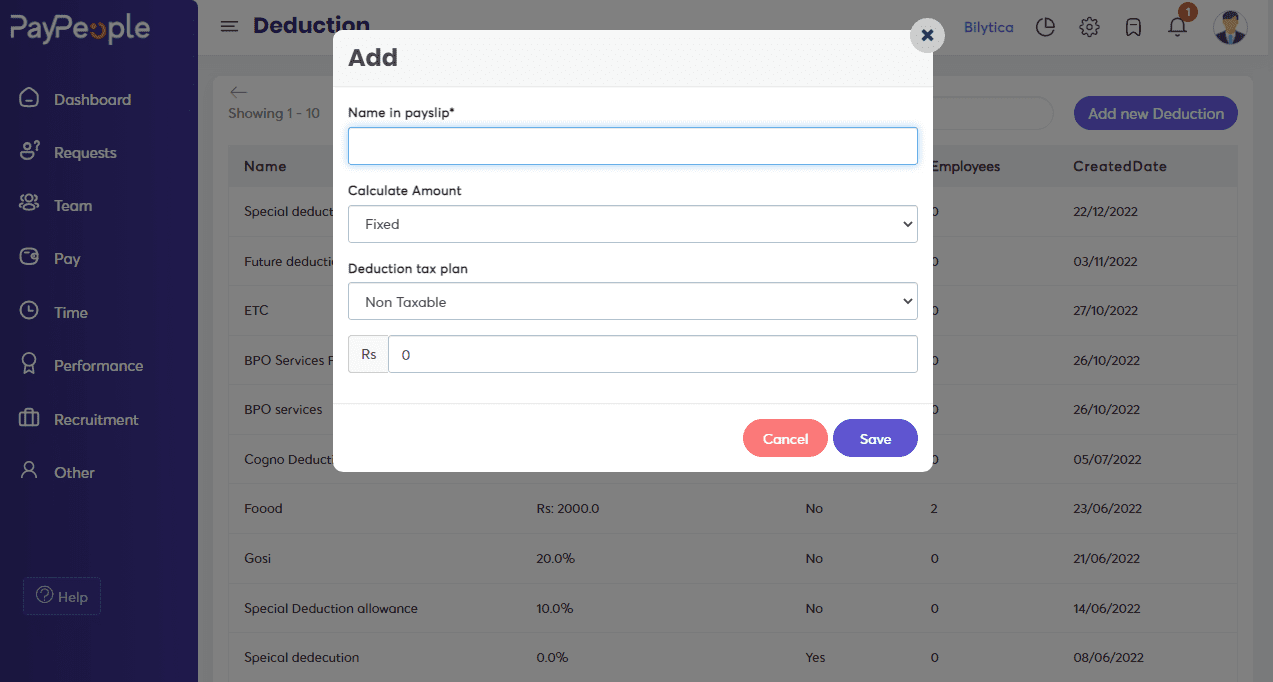

What you can do here:

- Give the deduction a name.

- Calculate Amount: The payment will be deducted from the salary as a fixed amount or as a percentage of the salary.

- Determine whether the deduction is taxable or not.

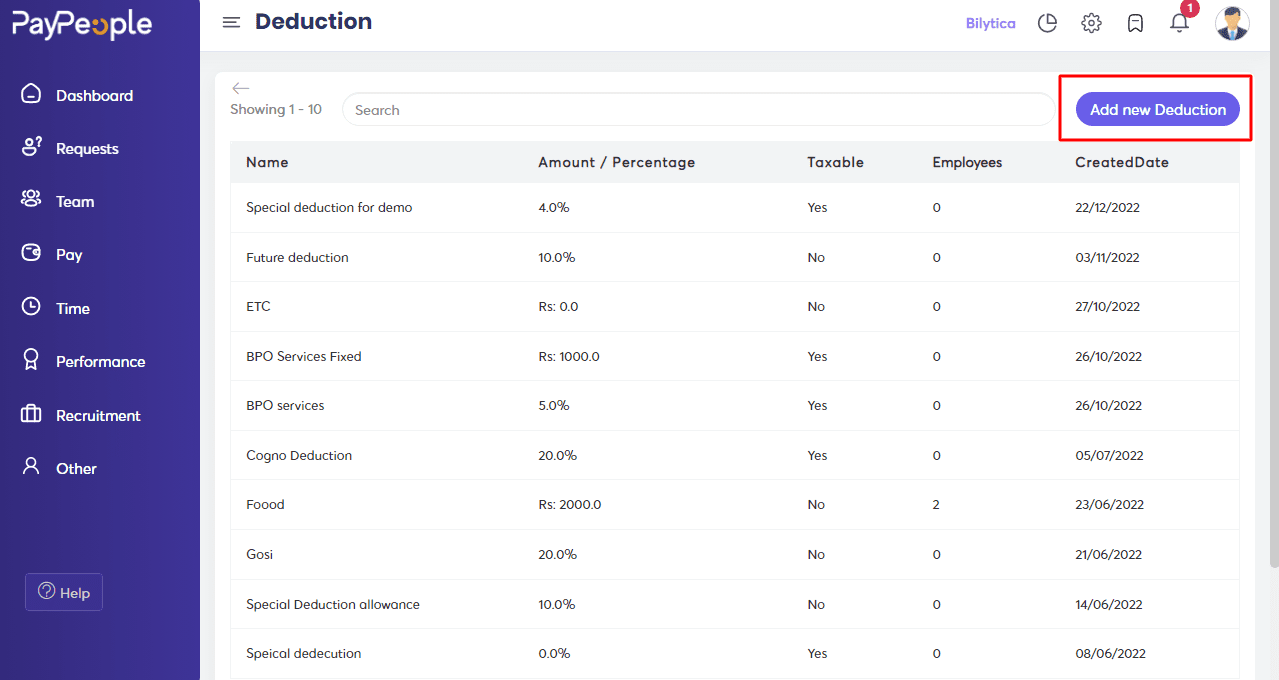

To create a deduction,

- Go To setup > Pay > Deduction

- Select “Add new Deduction” in the top right corner.

- Fill in the required fields that appear on the screen.

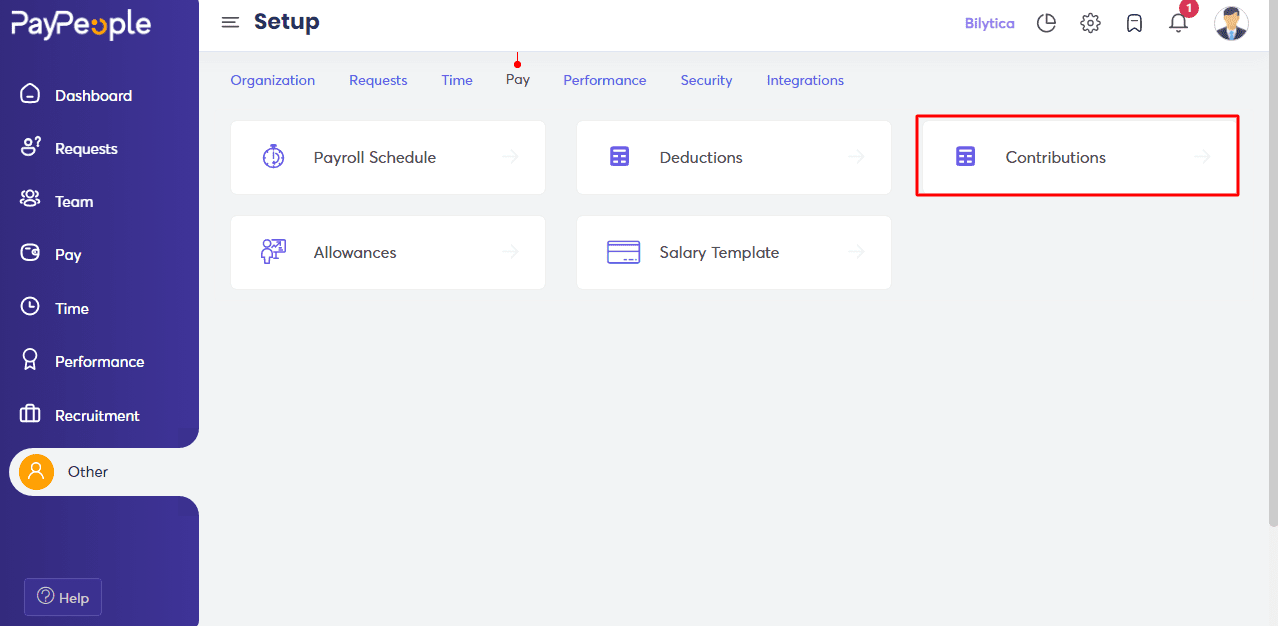

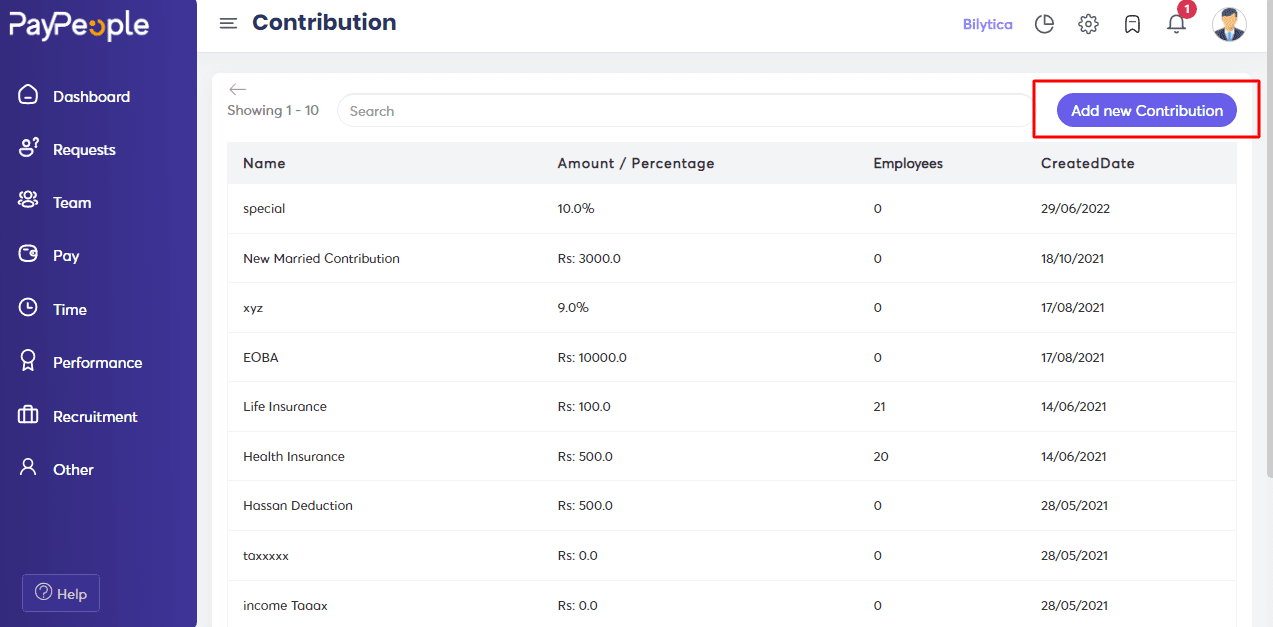

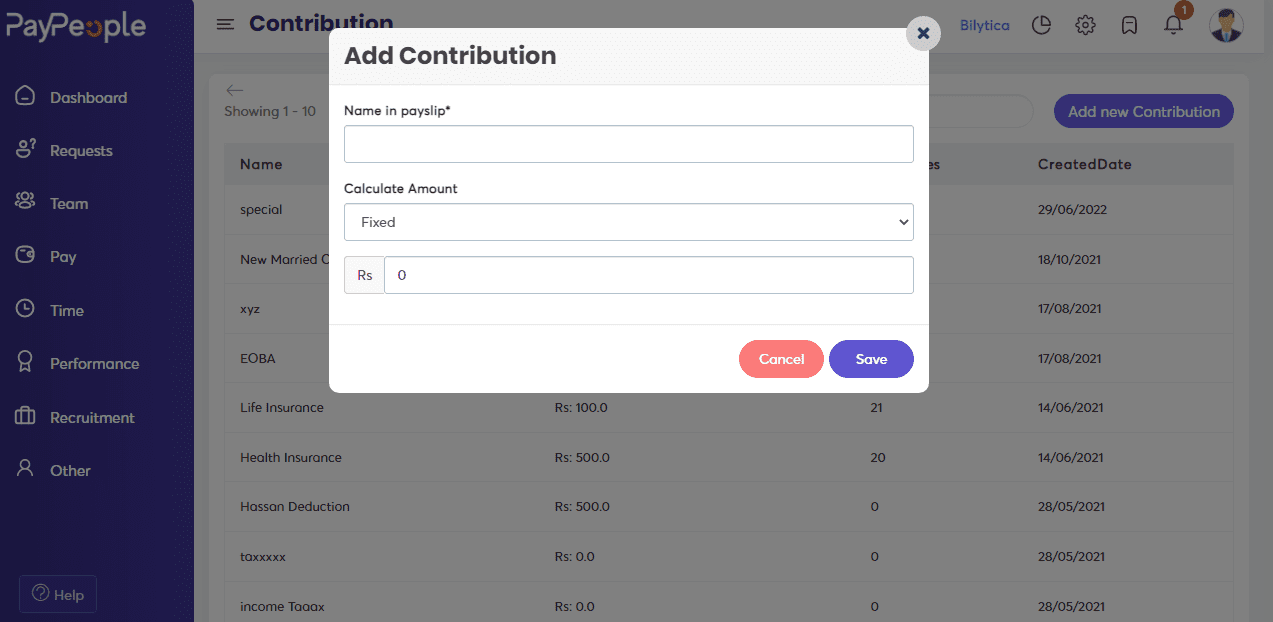

How to add a Contribution? #

PayPeople provides an attribute of contribution in which you can enter the amount of contribution to the employee profile.

- Give your contribution a name.

- Set the amount or choose between a fixed or a percentage of salary contribution.

To create a contribution

- Go To Setup > Pay > Contribution.

- Select “Add new Contribution” in the top right corner.

- Fill in the required fields that appear on the screen.

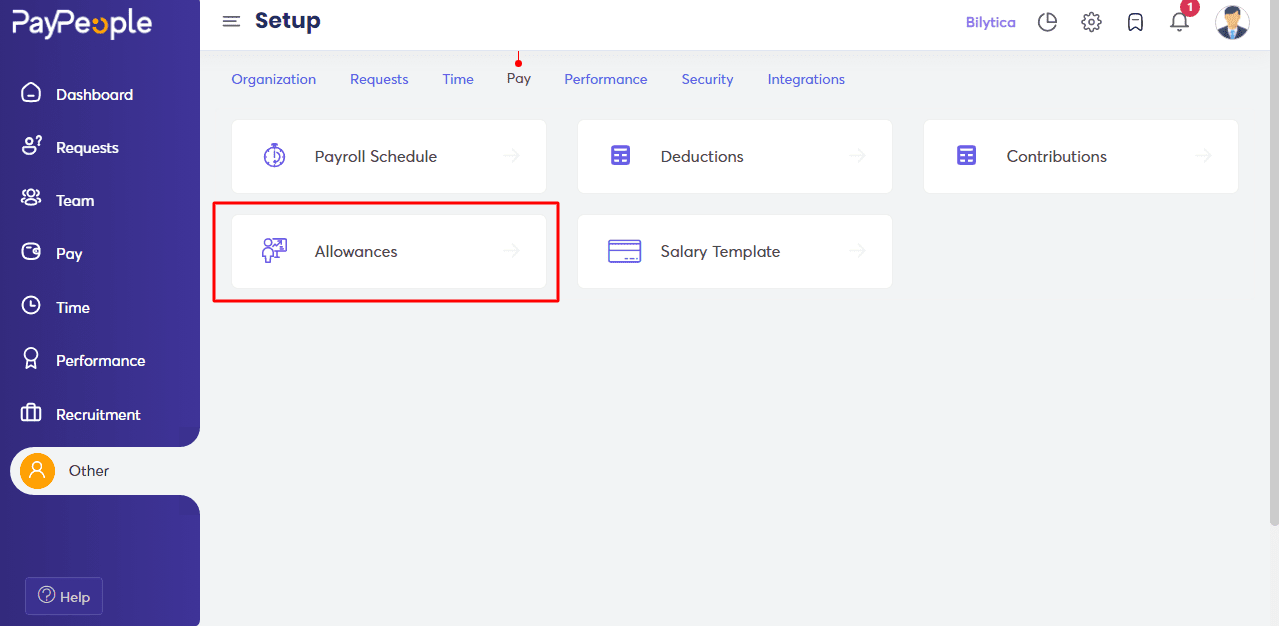

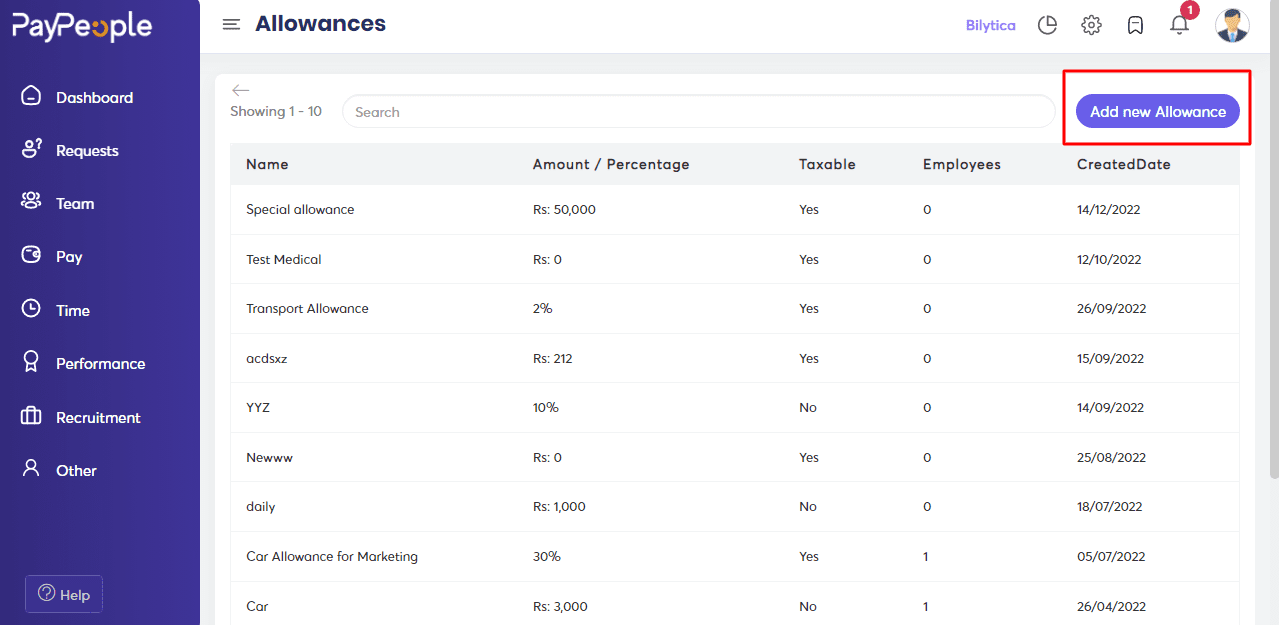

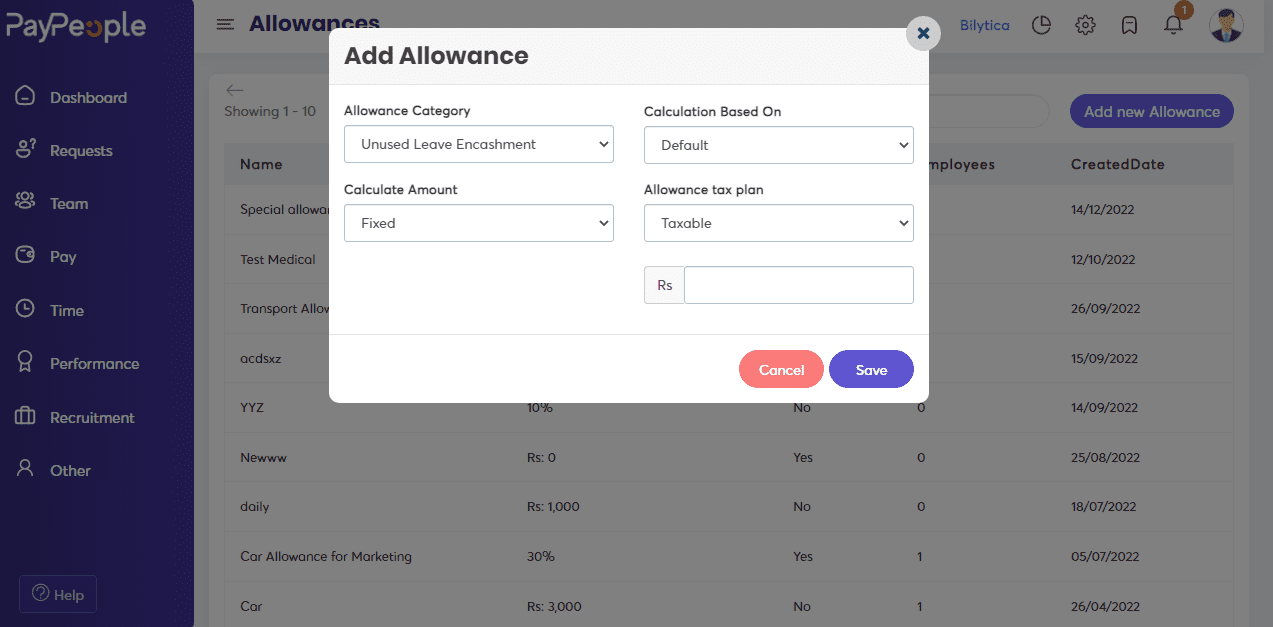

How to add Allowances? #

Different types of allowances can be added to an employee’s income using PayPeople. You can edit and reuse an existing allowance as well as create a new allowance.

What you can do here:

- Allowance type: Set the sort of allowance you want to include in the employee’s pay.

- Calculate Amount: The payment will be deducted from the salary as a fixed amount or as a percentage of the salary.

- Determine whether the deduction is taxable or not.

- Decide how much of an allowance you wish to provide your employees.

To create a new allowance,

- Go to setup > Pay > Allowance

- Select “Add new Allowance” in the top right corner.

- Fill in the required fields that appear on the screen.

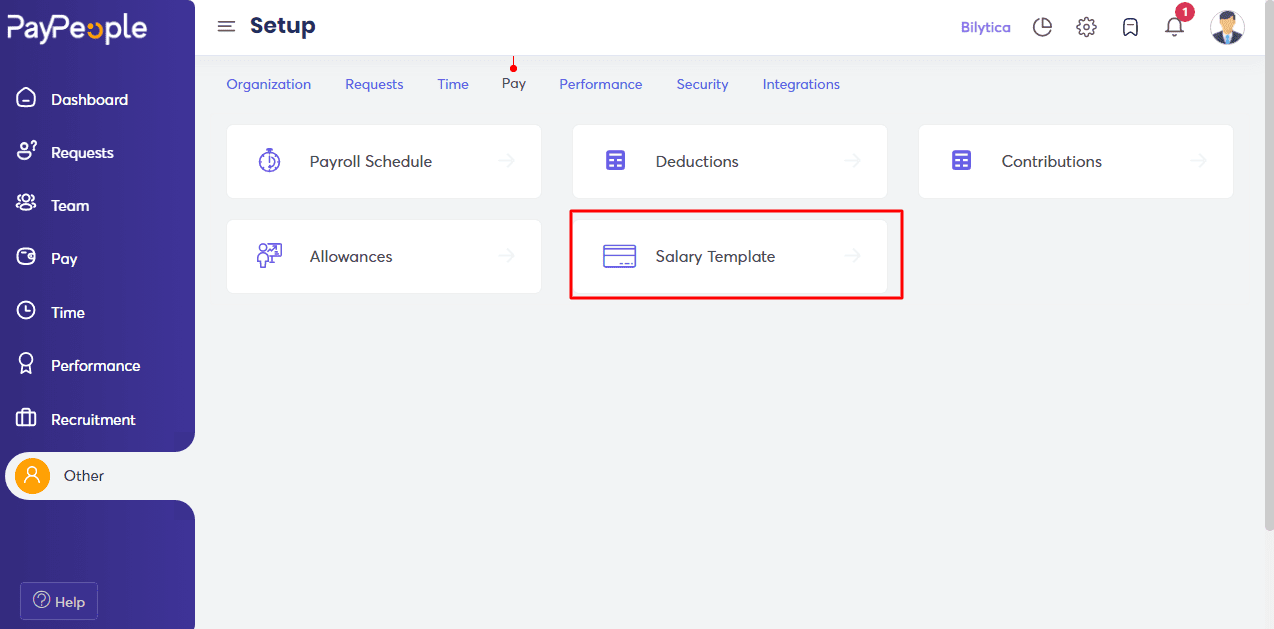

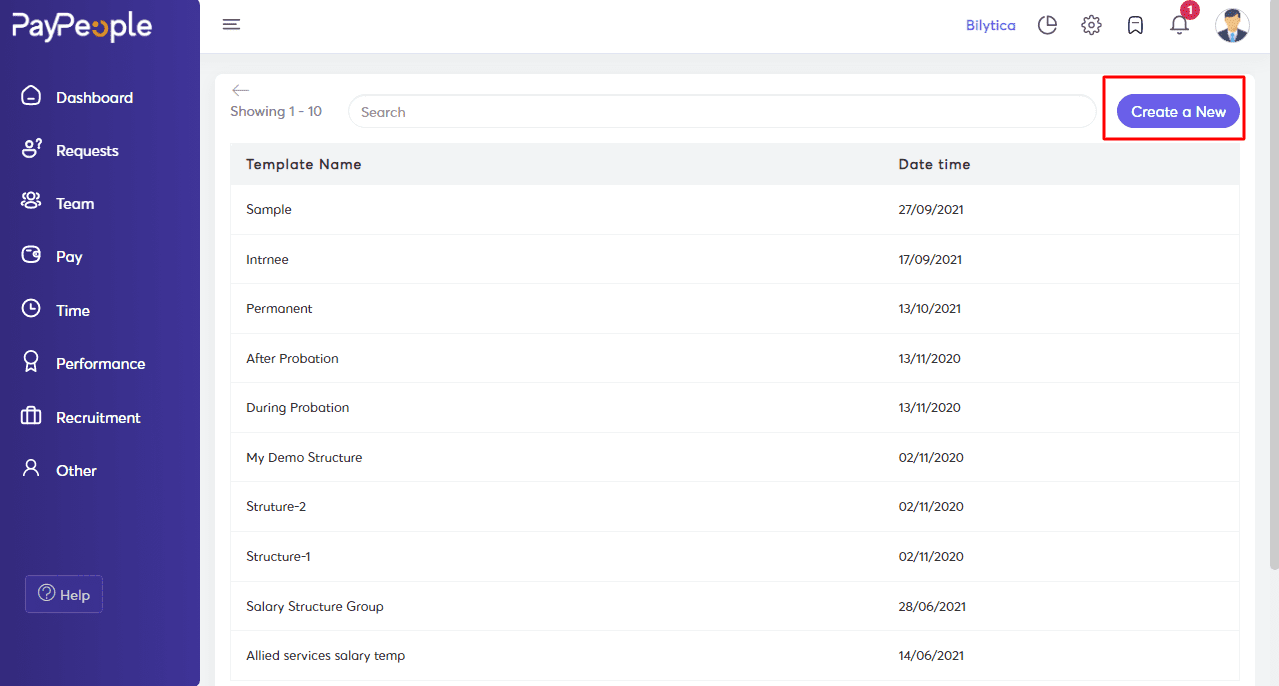

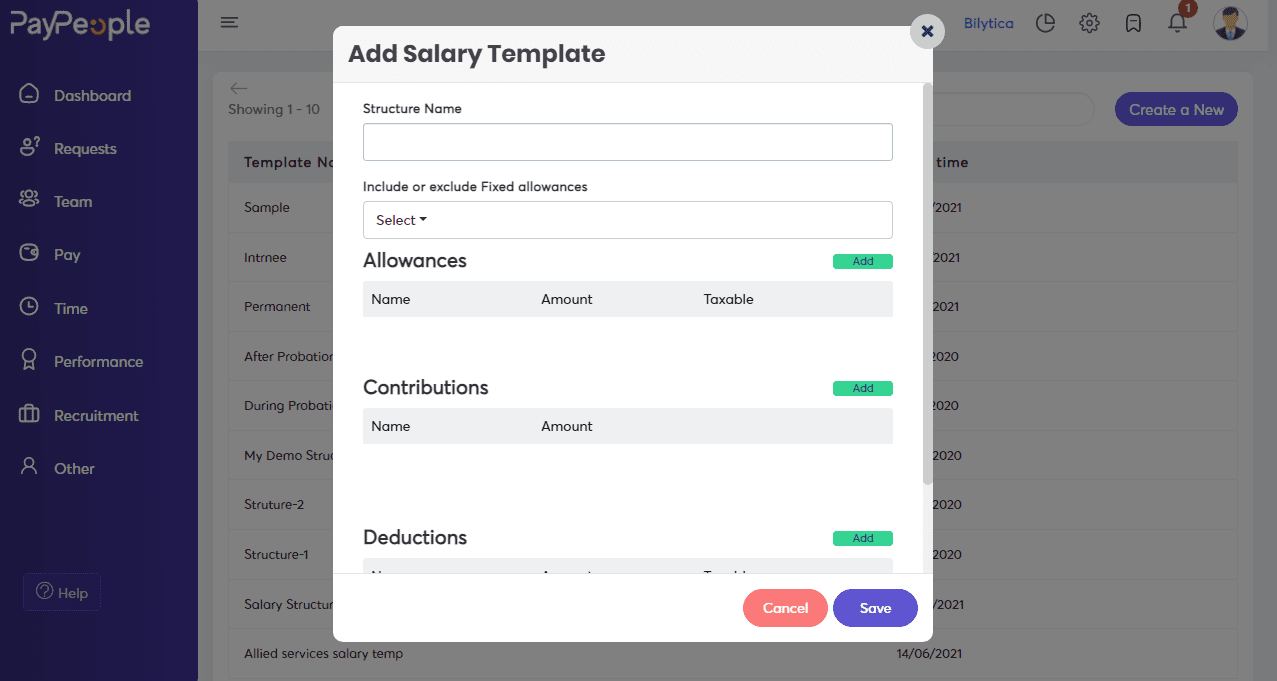

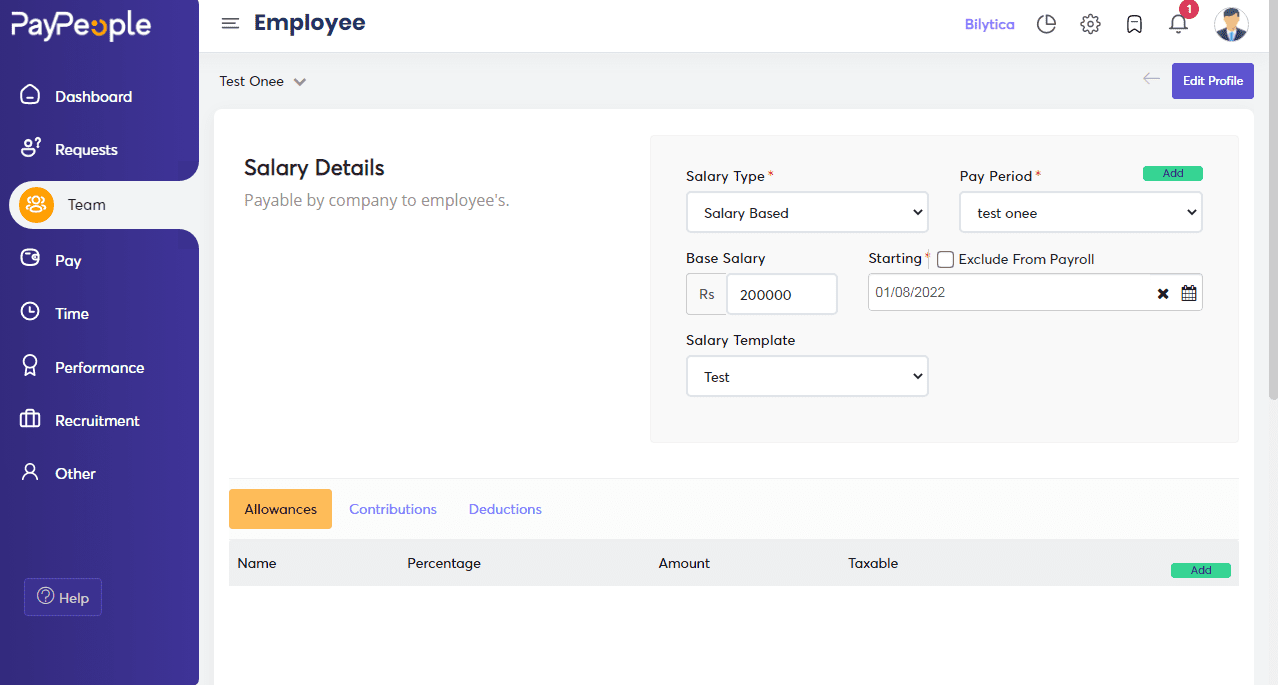

Salary Template #

Pay people have a salary template module that allows you to construct a Salary Structure with allowances, contributions, and deductions. It might be given to a single employee or to all of them.

What you can do here:

- Give your salary template a name.

- Different sorts of allowances can be added, such as fixed or percentage allowances.

- Contributions and deductions can be added to a salary template.

To create a salary template,

- Go to setup > Pay > Salary Template

- Select “Create a new” in the top right corner.

- Fill in the required fields that appear on the screen.

- Now assign the designed template to an employee in the employee profile.

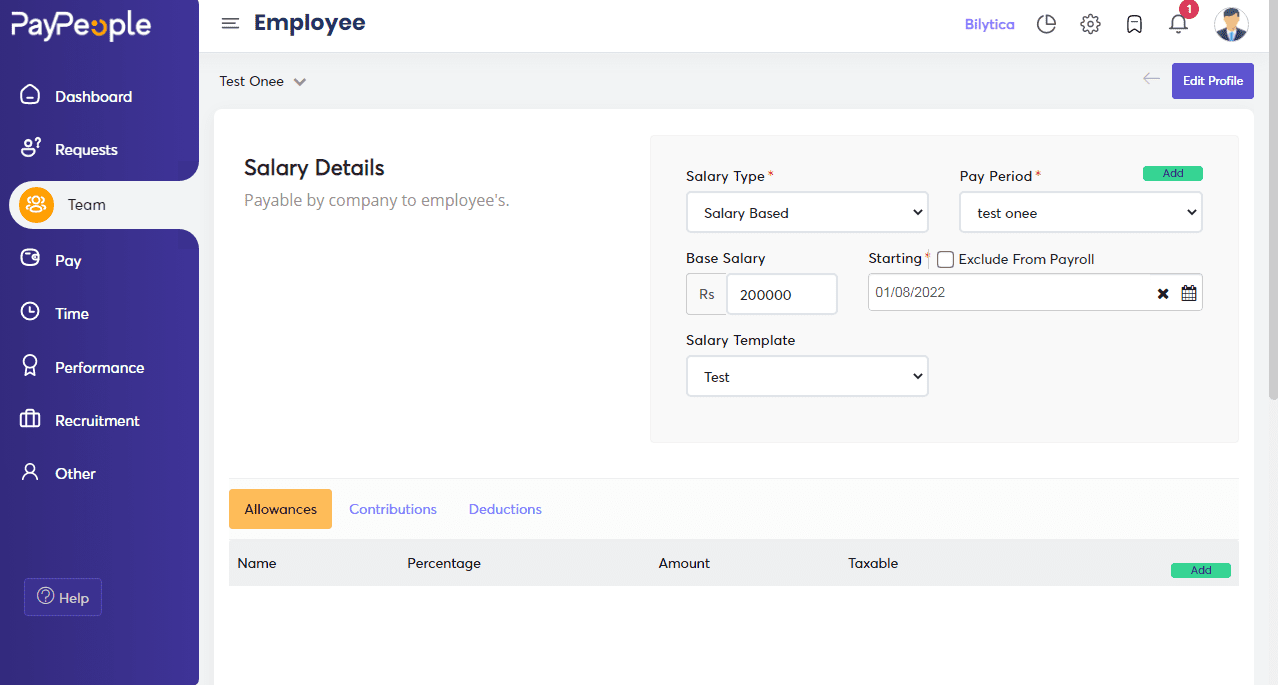

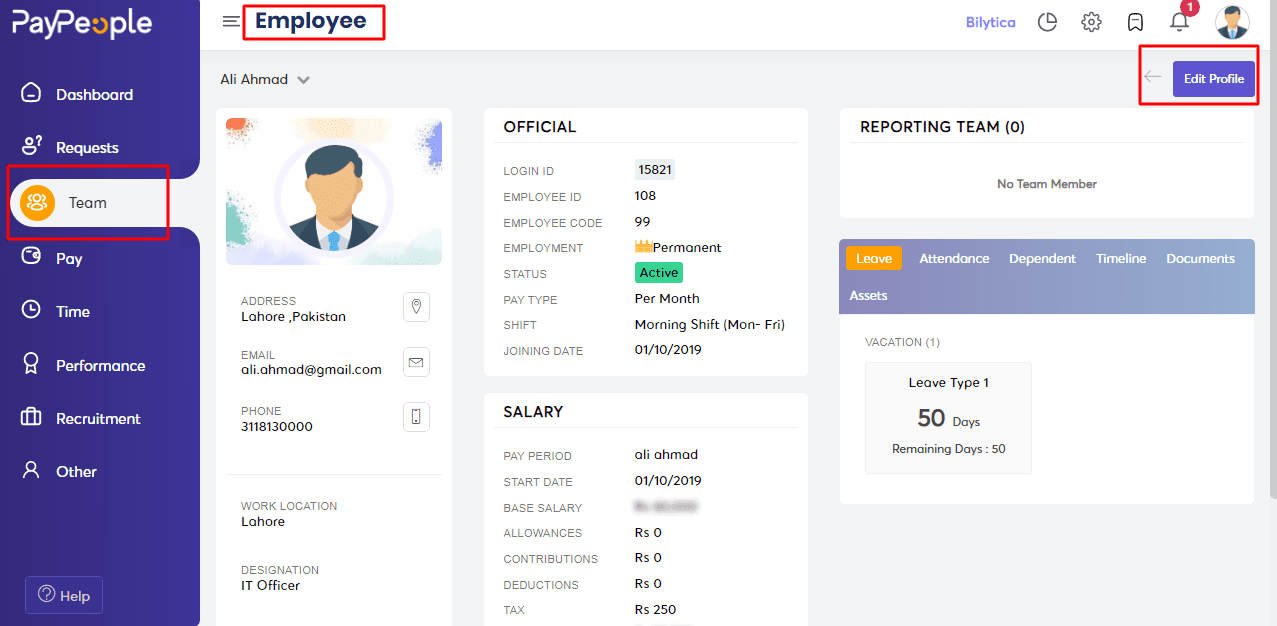

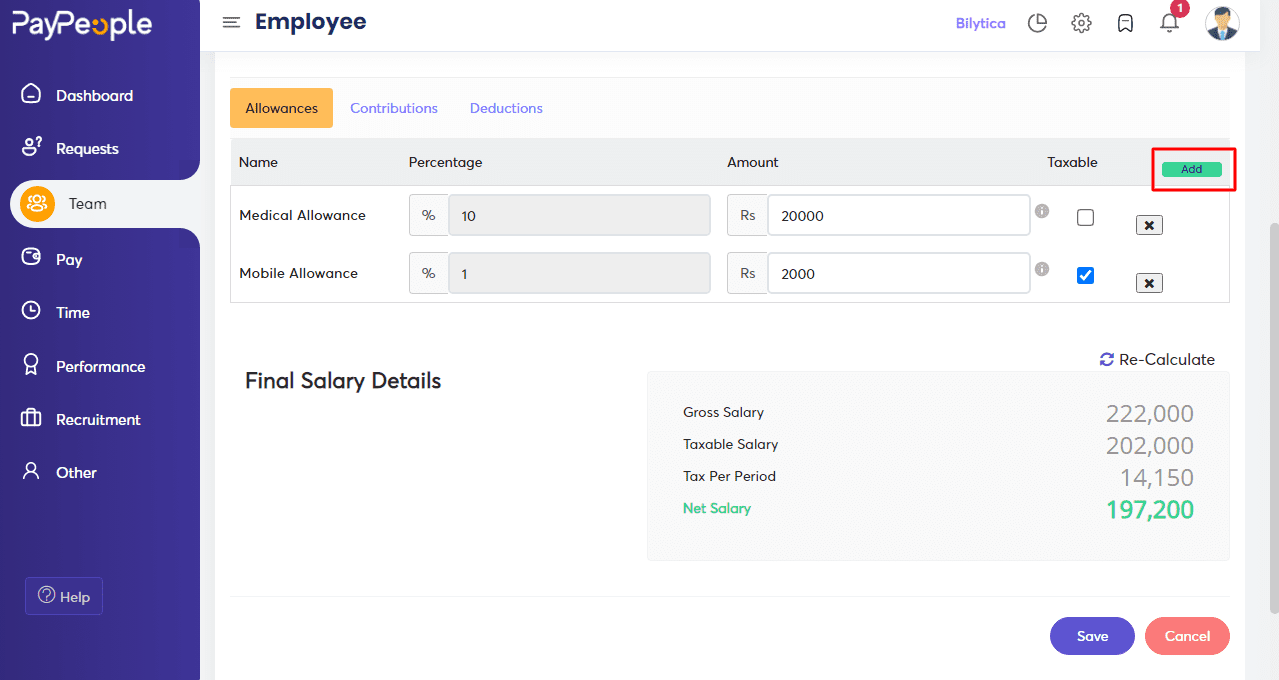

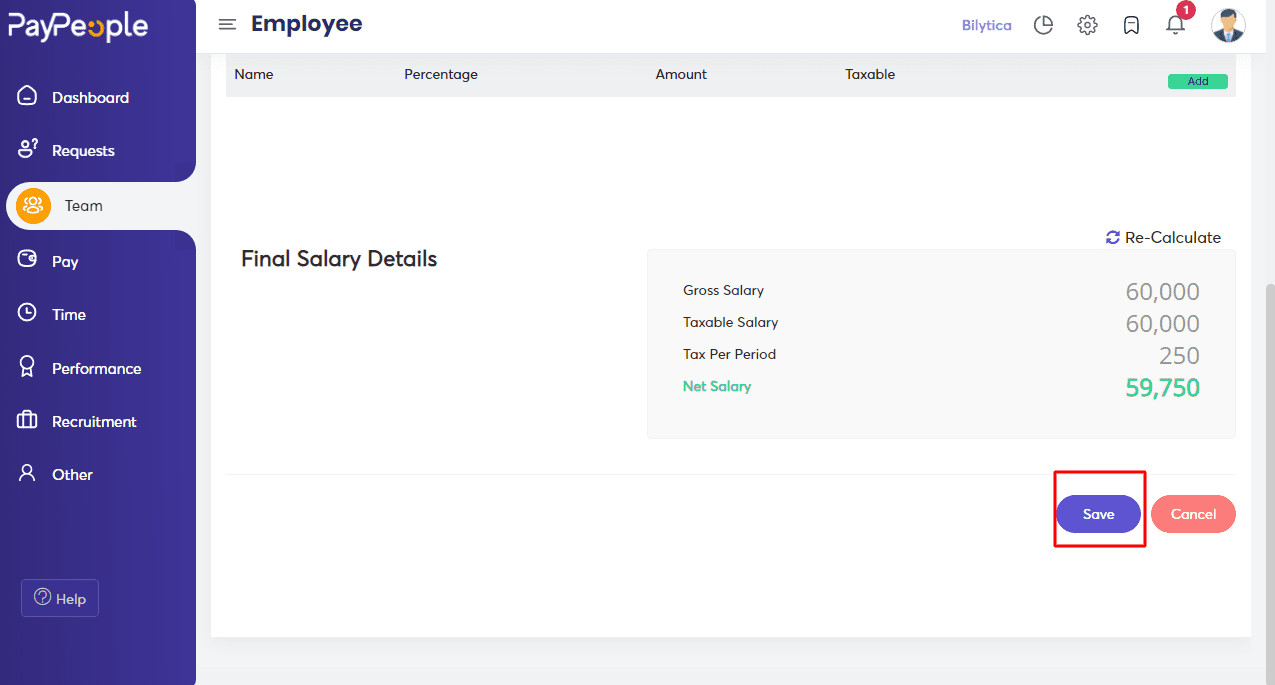

How to assign Payroll Elements to Employees? #

It involves setting up the correct payroll elements, as well as ensuring that the correct amounts are applied to the employee’s pay slip or bank statement each month.

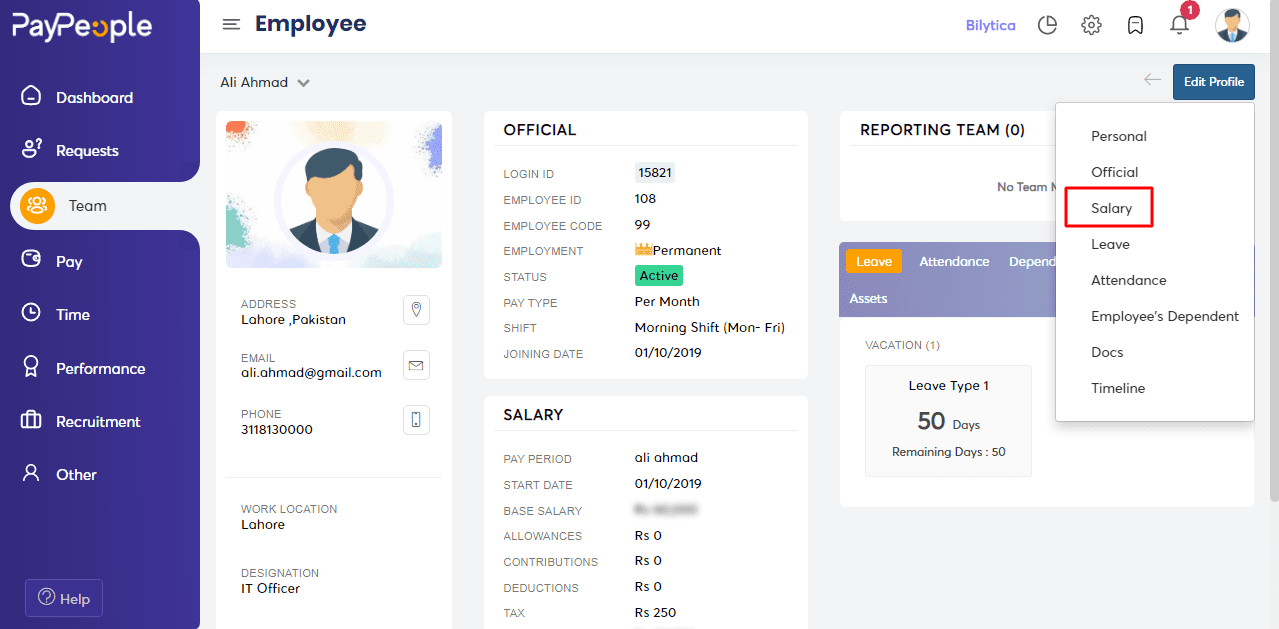

Manually Assign Elements #

- Go to Team -> click on employee -> click on the top right corner on edit profile.

- Click on Salary.

- Assign Payroll Elements to employees.

- Click on Add button.

- Click on Save.

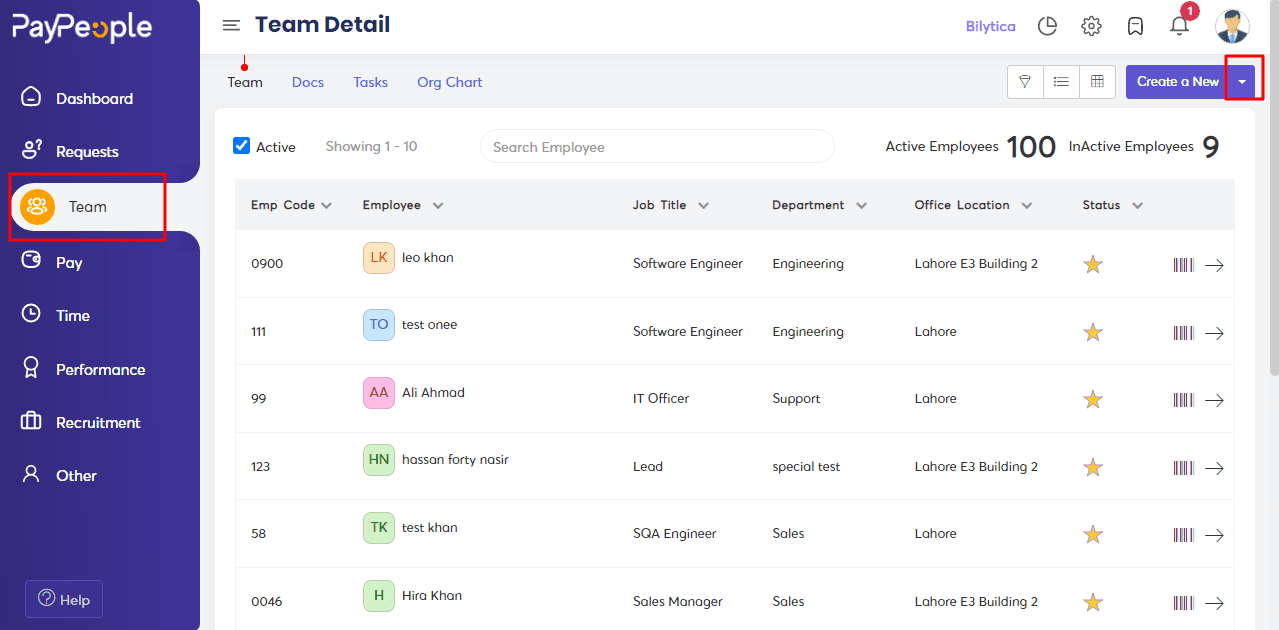

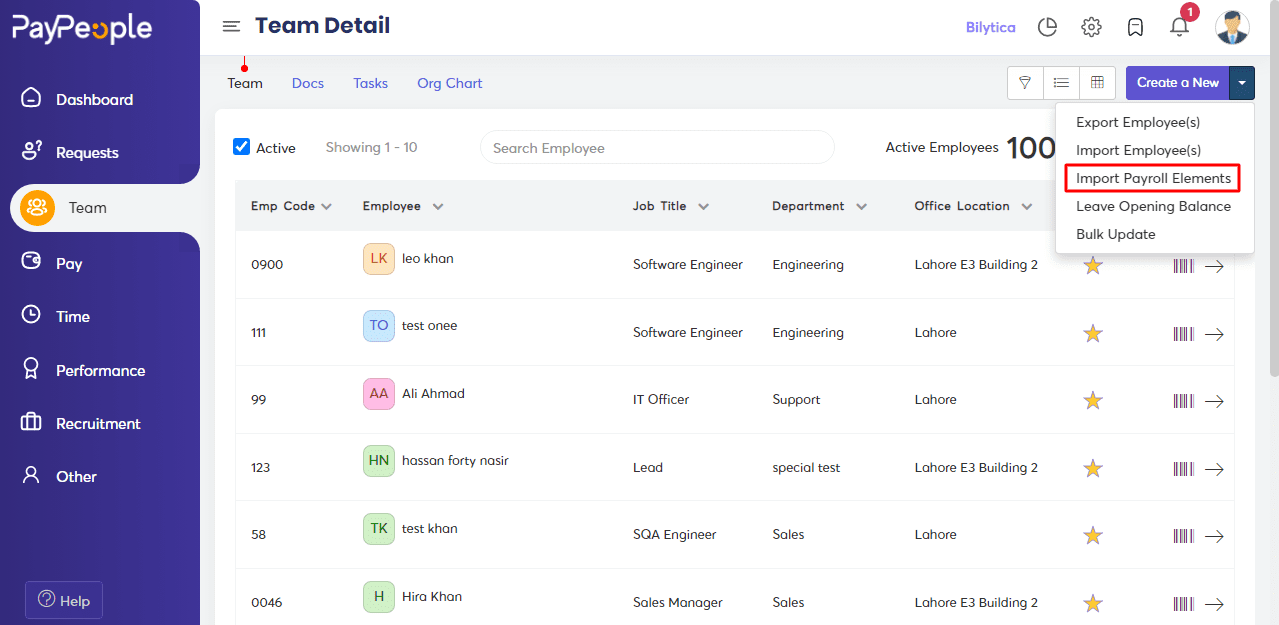

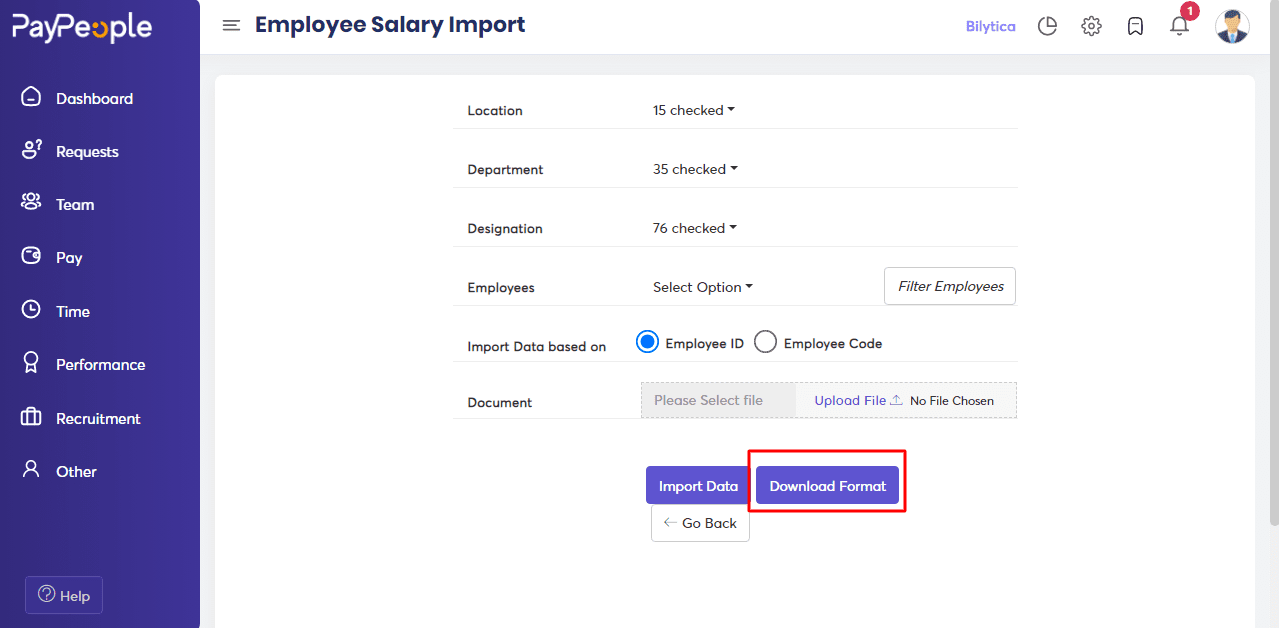

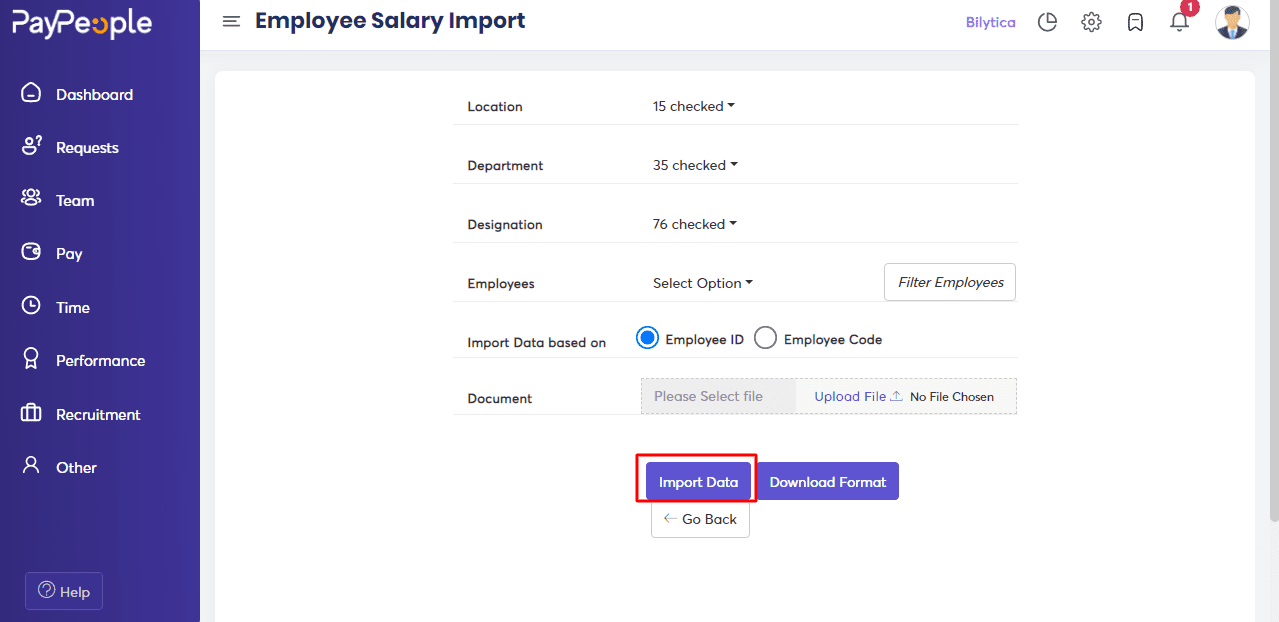

How to Import Payroll Elements? #

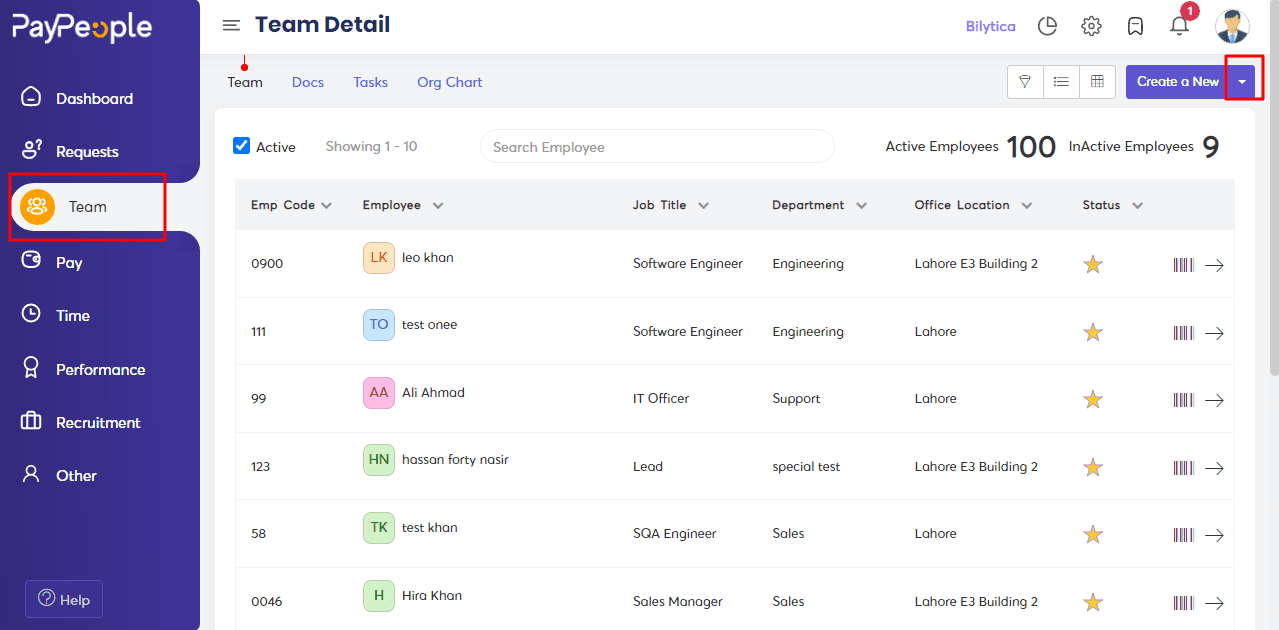

- Go to Team -> Click on the top right corner.

- Click on “Import Payroll Elements”.

- Apply Employee Filters and download the format and enter your required data.

- Upload the file and click on Import Data.

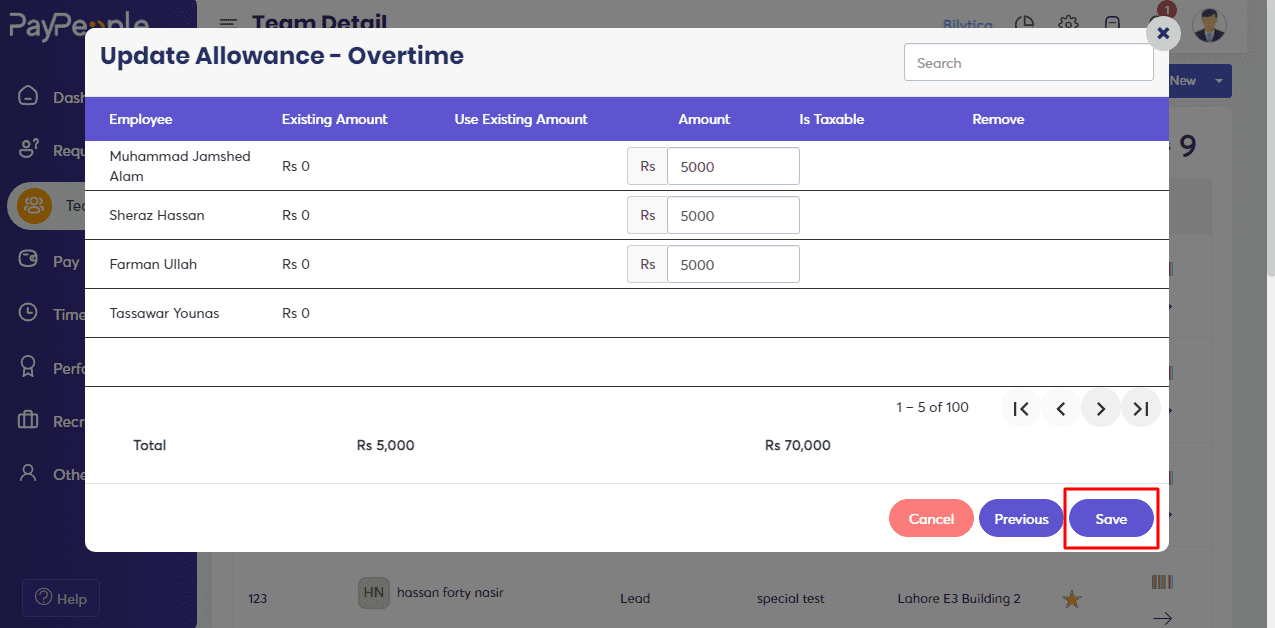

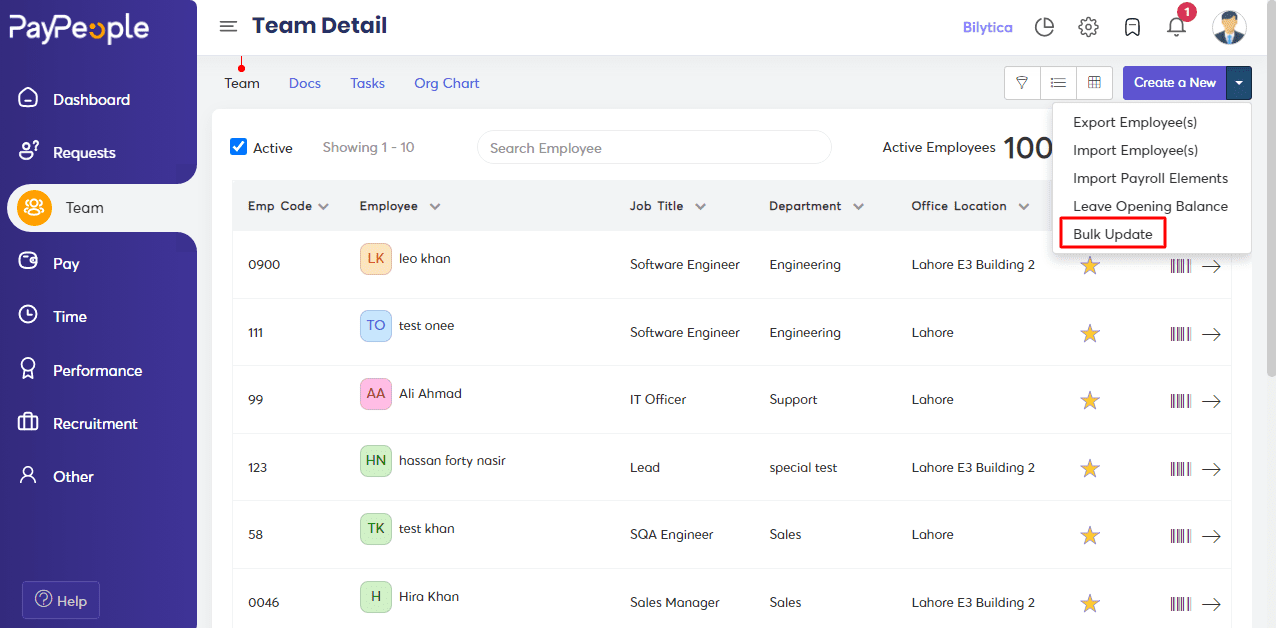

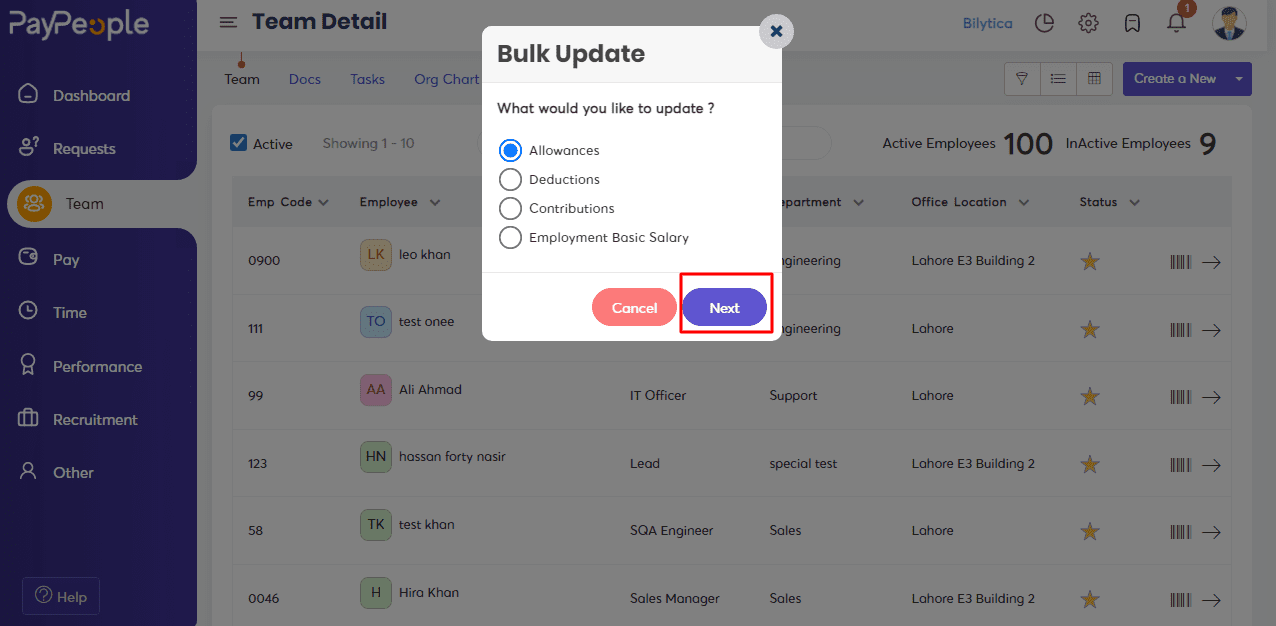

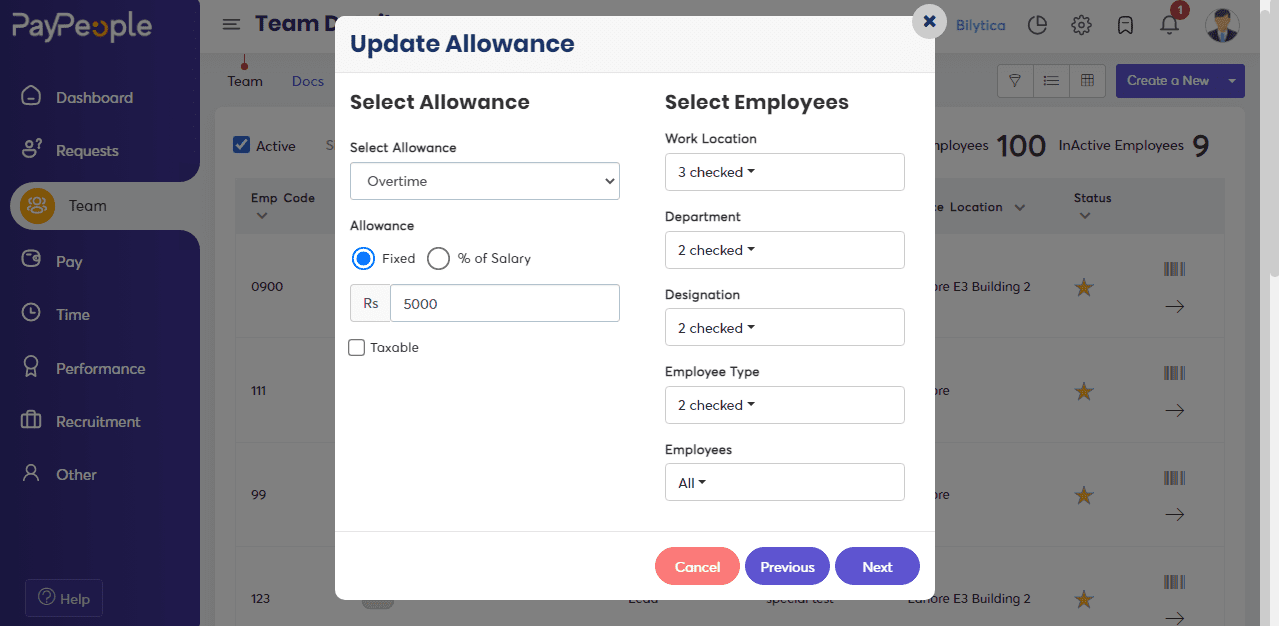

How to Update Data in Bulk? #

- Go to Team -> Click on the top right corner.

- Click on Bulk Update.

- Click on Next.

- Fill in the required fields.

- Click on Save.